Why choose Insightly Marketing?

Build pipeline and revenue

Engage with your audiences, create high-value leads, and grow your business.

Create lifelong customers

Drive loyalty through relevant messaging shared at just the right time in the buying journey.

The marketing app you’ll love

Align across sales and marketing to optimize the customer experience.

"*" indicates required fields

Engage audiences and build pipeline

Build trust and grow your business by delivering the right message to the right audience at just the right time.

Insightly Marketing Journeys are an intuitive solution that has helped our client drive a 10x increase in pipeline over just a few months by identifying prospects with a high propensity to convert.

Amy Anderson,

Co-Founder, Wild Coffee Marketing

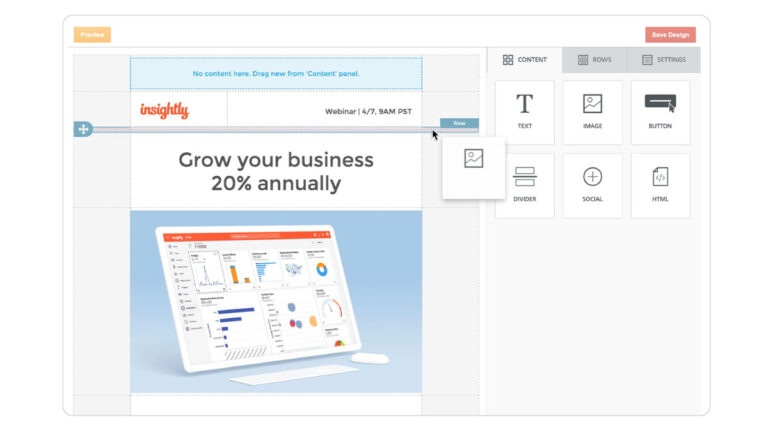

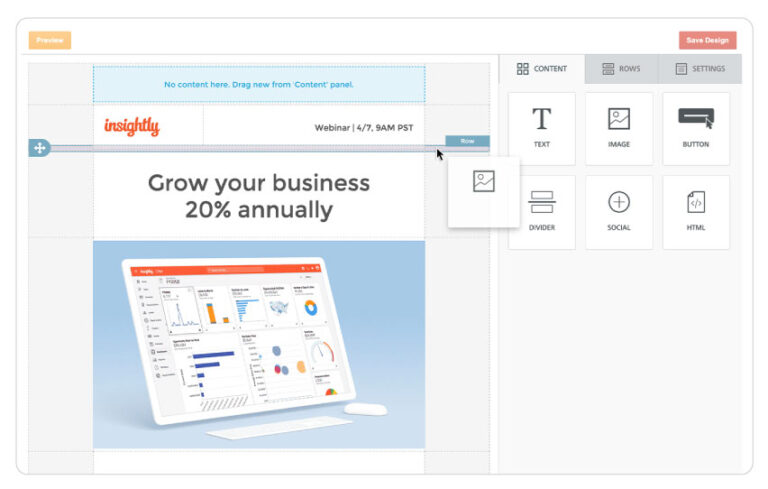

Email marketing

Quickly and easily create beautiful marketing assets that drive awareness and conversion.

- Launch great-looking, high-converting campaigns in minutes

- Use pre-built email templates or customize your own templates with intuitive drag-and-drop functionality

- Have more control over the way you reach customers with transactional emails and email batching

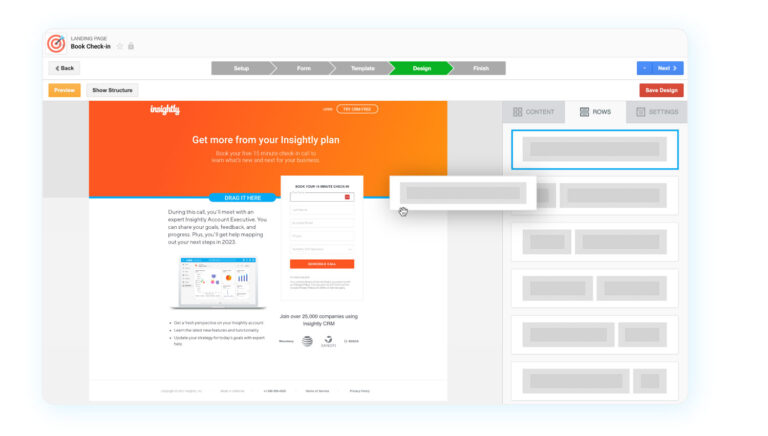

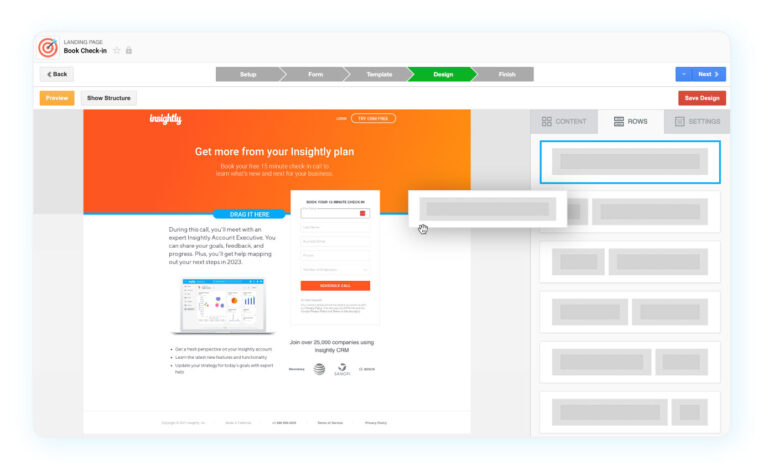

Landing pages and forms

Create high-quality landing pages designed to convert visitors to leads.

- Design, build, and clone beautiful, engaging landing pages

- Capture interest and engagement with embedded forms

- Share contact information automatically with sales and delivery for seamless follow-up

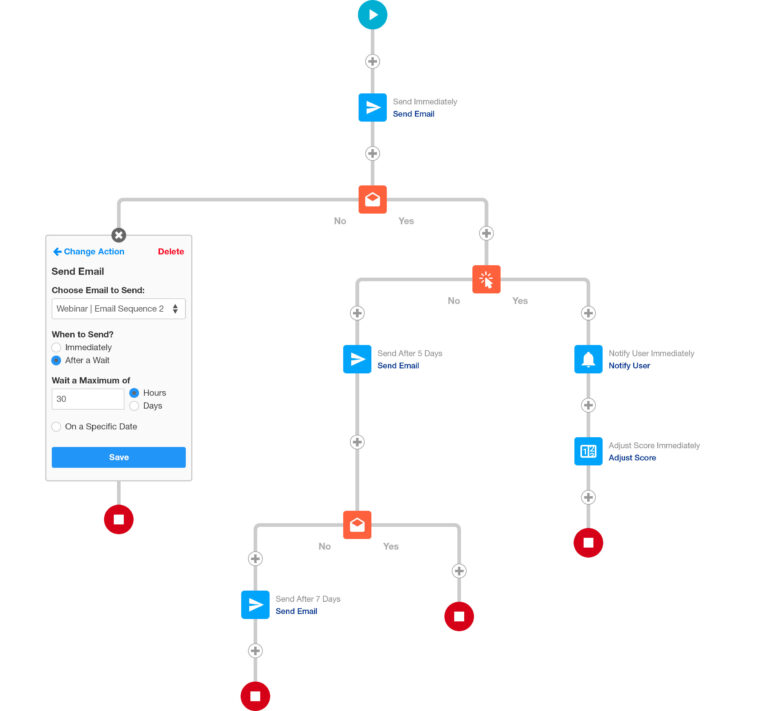

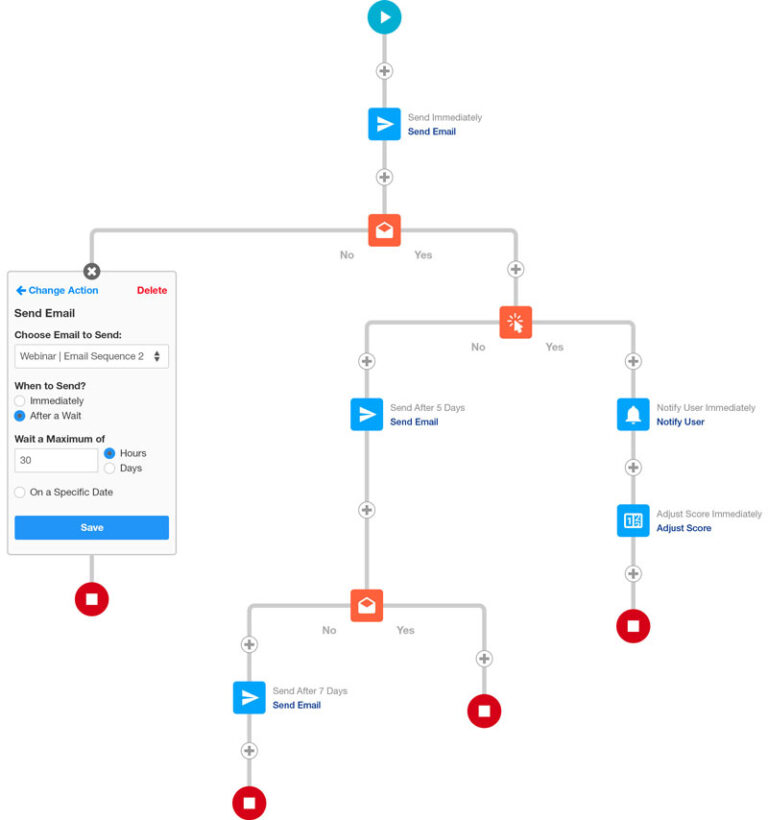

Journey builder

Create strong relationships by making every touchpoint insightful and engaging

- Easily build multi-step email sequences that guide customers from awareness to adoption and advocacy

- Nurture relationships with multi-touch content and logical next-best actions

- Automatically send notifications, change lead scores, or even trigger workflows based on customer interest and intent

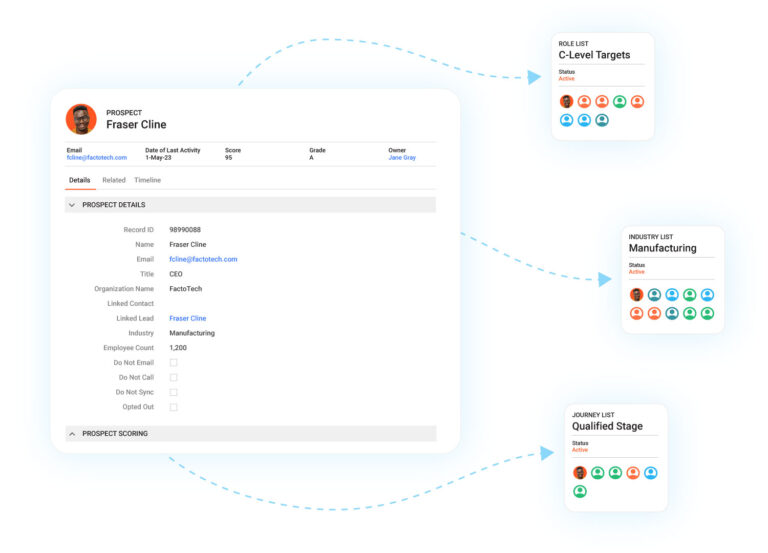

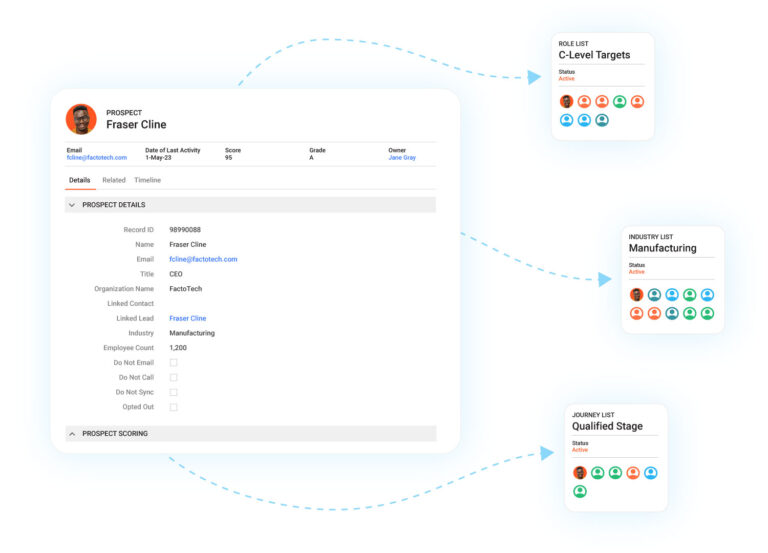

Dynamic list segmentation

Improve your brand reputation and your results by delivering relevant content that builds trust.

- Show customers you understand them and their business by dynamically adding or removing contacts from your lists

- Optimize conversion through improved targeting

- Monitor interest and purchase intent with prospect scoring and grading

- Segment by firmographic and demographic data and maximize your ability to reach the right person with the right message

Measure and iterate

Make smart decisions, understand what motivates your audience, then iterate and improve on your performance.

The number one biggest benefit of working with Insightly is transparency. Major decisions have to happen and we all have to be on the same page.

Kelsey Dus,

Marketing Director, SIGMA Equipment

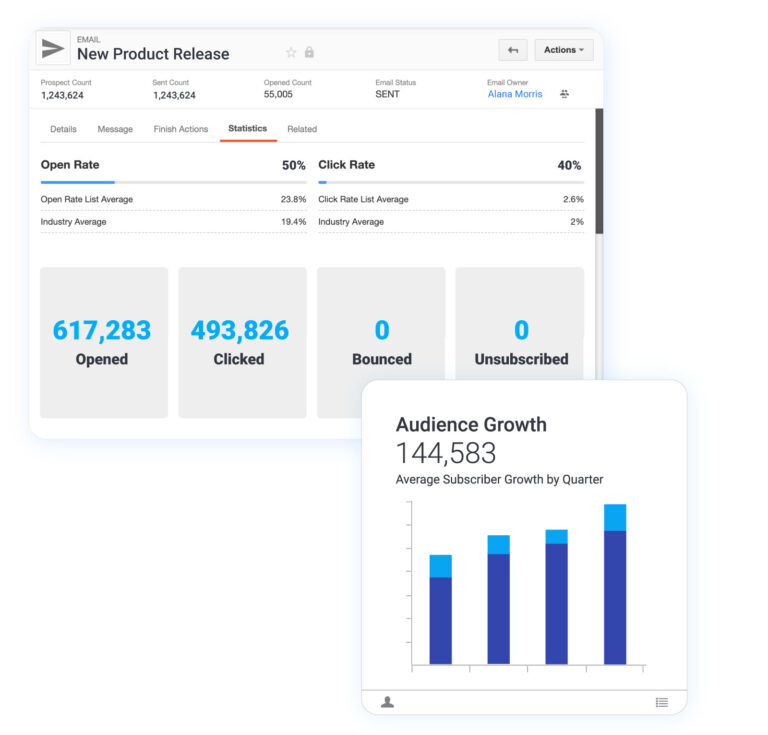

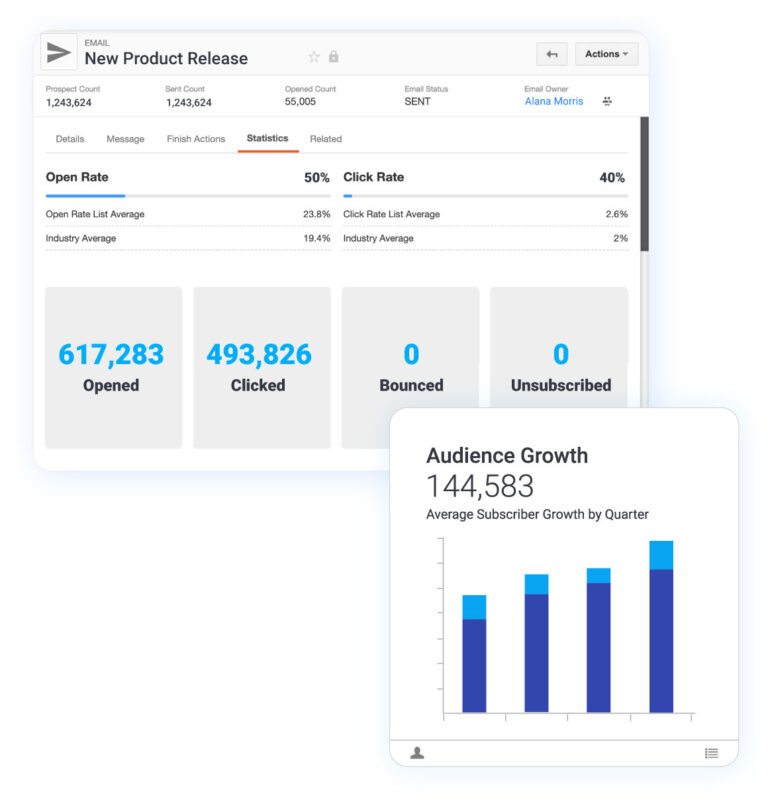

Dashboards and reporting

Create a single source of truth, share results across your entire organization, and demonstrate your impact.

- Track your unique KPIs with shareable dashboard cards and different chart types

- Evaluate and report on campaign performance with UTM tracking, multi-touch attribution, and ROI tracking

- Understand audience preference and intent with prospect ID tracking

- Improve email performance with health reporting

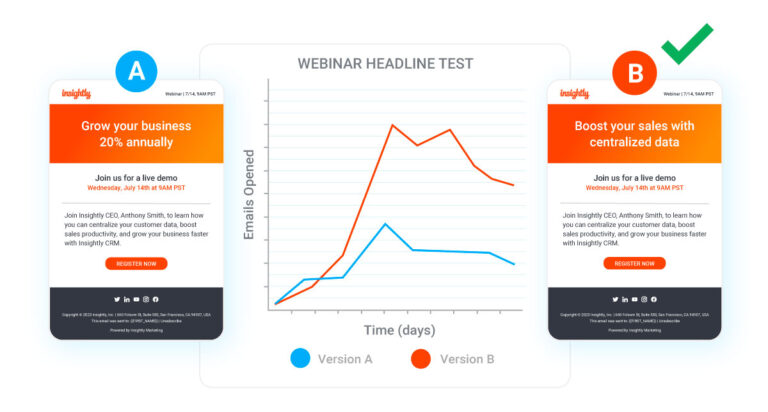

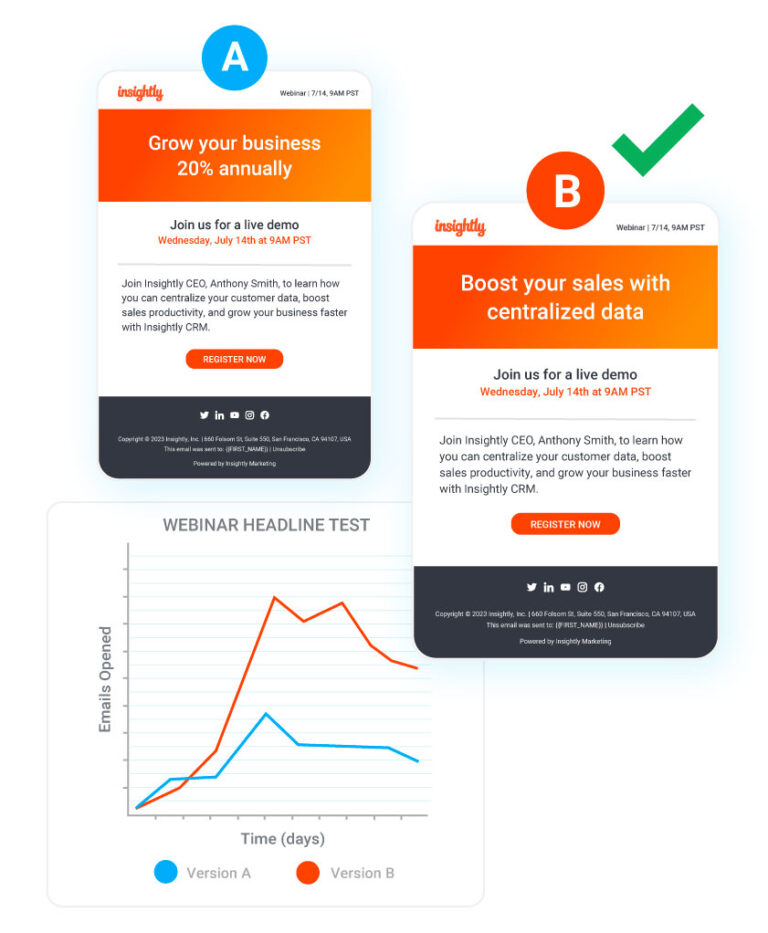

A/B and multivariate testing

Test, learn, and improve your email performance

- Understand what resonates for your audiences, and what doesn’t

- Improve your email campaigns and engage your audiences more effectively

- Go beyond basic A/B testing with easy-to-use advanced testing that will help you optimize results

- Improve email performance with health reporting

Integrate with ease

Share insights across your entire

organization and build strong

relationships with prospects

and customers.

Modern, unified platform

Extend your reach and drive sales with a unified experience across sales, marketing, and customer support.

- Show customers you know them with data captured across every single interaction

- Deliver great experiences across every single sales, marketing, and customer support touchpoint

- Easy to customize and integrate with the applications you use to run your business

AppConnect

Market smarter and grow faster when you connect Insightly Marketing to the rest of your tech stack.

- Capture leads more easily from all your digital advertising channels, like Google Ads, Facebook, Instagram, and LinkedIn

- Connect your eCommerce platform to Insightly, send targeted campaigns, and sell more

- Empower your marketing operations team to own all your integrations

CRM + Marketing Automation Yields 3x Revenue Increase

Manufacturing firm SIGMA Equipment shares the benefit of using Insightly CRM + Insightly Marketing to drive better cross-team communication, move faster, and generate more revenue.

Privacy and compliance

We use Insightly to run Insightly, so we make sure your data is as secure and safe as our own. We work with customers every day to make sure that their data security requirements are met and exceeded.

Experience Insightly Marketing for yourself

Frequently Asked Questions

Is marketing automation only for large financial services firms?

Firms of all sizes can benefit from marketing automation. Smaller firms will find that marketing automation helps their team do more with less by automating repetitive processes and freeing up marketers to do more creative tasks.

How is marketing automation used by financial services firms?

Marketing automation platforms help teams gather leads and disseminate content so financial services firms cab reach a wider audience more efficiently. By leveraging behavior-based signals, institutions can gain deeper insights into customer actions enabling more targeted and effective marketing efforts.

Do you need a CRM and marketing automation for a financial services firm?

CRMs are for storing and analyzing customer data. Marketing automation tools help marketers automate various day-to-day marketing tasks. Together, they can align your sales and marketing teams and help grow your finanacial services firm.

Marketing Automation for Finance

Marketing automation for the finance industry aims to streamline processes involved in marketing various financial products and services. When they leverage technology and data-driven strategies more effectively, financial institutions can optimize their marketing efforts, ensuring that they reach their target audience with personalized messages at the right time. Among the many benefits of adopting marketing automation are increased revenue generation, enhanced customer engagement, and reduced operational costs.

See moreAn industry where marketing automation has proven to be remarkably effective is business-to-business (B2B) transactions. B2B marketing automation enables financial institutions to engage with other organizations more fruitfully by automating repetitive tasks, segmenting potential clients based on relevant criteria, nurturing leads through targeted content, and measuring the overall performance of their campaigns. This way, finance-related companies can fine-tune their campaigns to resonate with decision-makers in other organizations and ultimately drive sales.

One aspect of B2B marketing automation that holds massive potential in the finance industry is lead nurturing. This involves guiding potential customers through their buyer’s journey by providing them with meaningful content at every stage until they make a purchase decision or become loyal clients. In this context, marketing automation for banks can help identify high-value prospects by monitoring online behavior or analyzing data from previous interactions to determine which individuals are most likely to convert into clients.

Additionally, marketing automation allows banks to send targeted messages based on customer behavior or preferences instead of blasting generic communications across different segments of their audience. This level of personalization not only enhances user experience but also increases the likelihood of conversion as customers feel more valued when receiving offers tailored to their specific needs.

Marketing automation for finance is not limited to large banks; smaller institutions can also benefit from these tools as they seek ways to compete against bigger players in an increasingly crowded market space. For instance, smaller banks can utilize email campaigns powered by automated workflows designed around certain triggers such as account openings or fund transfers which facilitate better communication between bank representatives and their clients.

Another substantial advantage of marketing automation in the realm of finance is the sheer volume of data that can be collected and analyzed. By combining financial information with behavioral insights, financial institutions can uncover hidden patterns and trends that better inform their targeted marketing strategies. This depth of analysis allows companies to make informed decisions about where to allocate resources and which initiatives are likely to yield the strongest returns on investment.

Marketing automation for finance offers an immense range of opportunities for financial institutions to enhance their marketing efforts, grow revenue, and improve customer engagement. B2B marketing automation empowers these organizations to design customized campaigns that resonate with other businesses, while personalized messaging driven by rich data helps build lasting relationships with individual customers.

Marketing Automation Strategy for Finance

Marketing automation strategy for finance is a vital approach to streamlining and optimizing marketing efforts in the banking and financial sectors. In an industry that thrives on precision, efficiency, and compliance, leveraging the power of marketing automation technology can yield significant benefits in customer acquisition, retention, and overall brand awareness. Bank marketing, which encompasses promotional activities specifically designed for banks and other financial institutions, has undergone massive transformations over the past decade.

Traditional advertising methods have given way to digital platforms that enable banks to engage with their customers more effectively. One such innovation driving this change is the incorporation of a comprehensive marketing automation strategy for finance. Finance marketing plays a crucial role in building trust among potential clients while maintaining a positive relationship with existing customers.

One valuable tool that many financial institutions are employing to achieve these objectives is CRM (Customer Relationship Management) marketing automation software. These sophisticated applications enable banks to centralize their client data while automating key aspects of their marketing campaigns. This streamlined process not only saves time but also allows for more targeted outreach efforts based on individual preferences or behaviors.

A well-designed finance marketing strategy should integrate CRM marketing automation features such as lead scoring, email triggers, customer segmentation, personalized content creation, campaign analytics, and social media management tools among others. By leveraging these capabilities effectively within the context of bank marketing initiatives, financial organizations can enhance their ability to connect with customers across various touchpoints while ensuring consistent messaging throughout their campaigns.

The shift towards digital platforms and technologies has revolutionized the way banks and financial institutions market themselves to their clientele. Employing a holistic marketing automation strategy for finance can significantly enhance campaign efficiency, enabling more targeted outreach efforts while fostering customer loyalty and trust. By integrating CRM marketing automation tools into their overall finance marketing strategy, these organizations can successfully navigate the evolving landscape of bank marketing and position themselves as leading providers of financial products and services.

CRM for Finance

Customer relationship management (CRM) systems have become an indispensable tool for businesses across various industries to streamline their operations and maximize efficiency. The finance sector, in particular, stands to benefit immensely from the incorporation of CRM for finance into their daily operations. This powerful technology, a CRM built for finance,can help financial institutions manage customer data, personalize interactions, improve sales performance, and much more. Your CRM software for finance is as important and your CRM strategy for finance.

One crucial aspect of any successful CRM system is CRM automation. With the growing demands of modern customers for quick responses and personalized services, it has become imperative for financial organizations to make use of automated processes that can deliver fast and accurate resolutions to customer inquiries. CRM automation allows finance companies to minimize manual intervention in various tasks like lead assignment, follow-ups, account updates, and many more. By automating mundane activities, CRM helps employees focus on more critical aspects such as providing better customer service or closing deals.

A well-implemented CRM strategy for finance can provide organizations with a competitive edge in the highly saturated market. The primary objective of this strategy should be the consolidation and organization of customer data from different sources into a single platform. It would enable employees to have a 360-degree view of each client’s history, preferences, transactions, etc., making it easier for them to understand their needs and suggest appropriate solutions.

Moreover, a robust CRM system should also facilitate seamless collaboration among various departments within a financial institution – ensuring all teams are working together toward achieving common goals. An effective finance CRM should integrate multiple functionalities tailored specifically for the industry’s unique requirements.

Incorporating a CRM system into the operations of finance companies can lead to a considerable improvement in their overall efficiency. By leveraging CRM automation and implementing a comprehensive CRM strategy for finance, institutions can provide better services to their customers while staying ahead of the competition. As more financial organizations realize the benefits that CRM technology has to offer, it is expected that its adoption will only continue to grow – heralding a new era of streamlined operations and exemplary customer experiences for the industry.

Best Marketing Automation for Finance

The realm of finance is a dynamic landscape, constantly evolving and adapting to the ever-changing market conditions. Financial institutions and professionals alike need to stay ahead of the curve to remain competitive and ensure the continued growth of their businesses. One key aspect that can make or break the success of any finance-related business is its marketing strategy.

Marketing automation platforms are designed to streamline and optimize various aspects of a marketing campaign, eliminating repetitive tasks, and enabling better targeting of potential clients. This technology has revolutionized the way businesses approach their marketing efforts, providing them with valuable insights into customer behavior and preferences. By leveraging these insights, financial institutions can craft more effective marketing strategies, resulting in higher conversion rates and increased revenue.

One such marketing automation tool that has proven invaluable for financial services providers is Insightly Marketing. This comprehensive platform offers a wide range of tools specifically tailored toward financial organizations’ needs, including lead scoring, email marketing, social media management, analytics tools, and more. The robust features offered by Insightly Marketing enable companies to harness the power of data-driven decision-making while simultaneously automating time-consuming tasks.

Another prominent player in the world of marketing automation for finance is Marketo, however it comes with an enormous price tag that makes it difficult to justify the cost. Marketo’s robust feature set allows financial institutions to effectively manage all aspects of their inbound and outbound campaigns. From managing email campaigns to nurturing leads through personalized content delivery, it provides companies with a powerful suite of tools designed to address every facet of their digital presence. The integration capabilities offered by a modern-day marketing automation system make them a solid choice for financial services providers looking to further centralize their operations, however similar features can be found at a significantly lower price point with Insightly Marketing.

By connecting disparate tools and platforms under one roof (such as CRM databases or third-party applications), companies can maximize efficiency while reducing the likelihood of human error. Additionally, working hand-in-hand with specialized marketing services agencies can help financial institutions fine-tune their marketing automation strategies. These agencies can provide valuable insights into best practices and offer expert guidance on implementing cutting-edge tactics and technology to ensure the greatest possible ROI.

Embracing the right marketing automation tool is essential for financial institutions looking to stay competitive in today’s fast-paced market. By harnessing the power of these platforms, companies can streamline their marketing efforts, automate time-consuming tasks, and make data-driven decisions that directly contribute to their bottom line. With numerous options available, it is crucial to carefully assess each platform’s offerings and choose the one that best aligns with a company’s unique needs and goals.